All Categories

Featured

Table of Contents

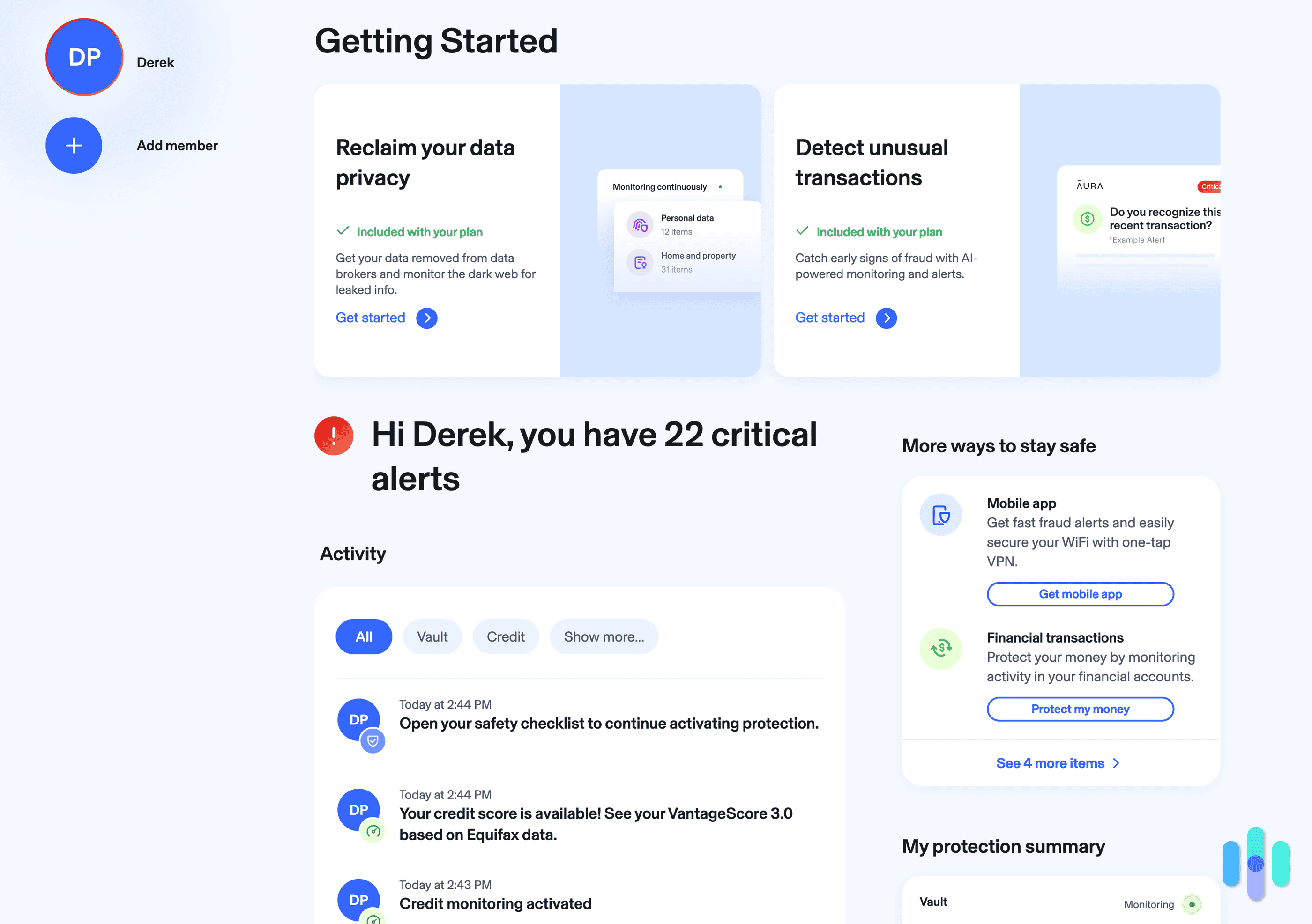

Mood ran in the history of our day-to-day digital life. Aura has plans for individuals, pairs, and households of up to five grownups and unrestricted kids.

This is an outstanding selection for single moms and dads. The Individual plan with the Kids add-on offers extensive coverage for every person at just $22 per month. Younger folks get scammed much more commonly, however when seniors (70+) obtain scammed, they often tend to shed the most cash.

IdentityForce caught the very same activity as well, yet its alerts came a couple of hours later (click here). Superior identification theft defense and cybersecurity collection in one As much as $3 million coverage Added digital protection features for children Synthetic identification burglary protection Household prepare for 2 grownups and five children can cost as much as $79.99 Costs rise after the initial year Multiple applications need to be mounted Limited credit score defense attributes in lower-tier registrations (Select, Standard, Benefit) Aside from monitoring credit scores data and brand-new account applications, our LifeLock Ultimate Plus additionally checked: 401(k) and investment accounts Financial institution and bank card activities (withdrawals, equilibrium transfers, etc) Payday advance with cash advance lock Purchase currently, pay later acquisitions Not all LifeLock strategies consist of three-bureau credit report surveillance

We downloaded two apps a LifeLock application and a Norton application. While an all-in-one remedy would certainly be nice, Norton provides numerous digital safety and security devices that it makes good sense to split them up for much easier access. LifeLock aids eliminate our individual details from information broker sites. You'll receive several protection informs from LifeLock in the first week as it determines information breaches and revealed information.

An Unbiased View of Identity Protection Tools

And truthfully, the higher-tier LifeLock strategies often tend to set you back even more than the sector standard. If spending plan's a top priority, Mood and Identity Guard come in less costly, yet if you do not mind spending in premium defense, LifeLock is worth looking right into.

It happened to us when a person attempted taking a loan out in our name and when we were late paying a costs. If you require to freeze your credit scores, NordProtect directs you to TransUnion's internet site. You'll take care of them directly to secure your score. It's not as effortless as LifeLock and Aura, however it's reliable.

The very first scan we ran got on the dark web. NordProtect can keep an eye on as much as five email addresses, contact number, and credit scores and debit card numbers. It needs to cover a household, although NordProtect doesn't offer devoted family strategies - click here. While it's an excellent feature, we want to see NordProtect add more alternatives, like passport and driver's licenses, in future updates.

After spending a month with NordProtect, we like that it offers preventative securities versus on-line assaults as well as responsive alerts when risks are detected. A few of the monitoring attributes are lighter than LifeLock and Mood, yet NordProtect is a trustworthy alternative if those services are except you. Like other Nord products, NordProtect's core service equals with all plans.

The smart Trick of Identity Protection Tools That Nobody is Talking About

, and TotalAV, for instance, all fold some type of ID theft tracking right into their malware security. We found Identification Guard's desktop computer dashboard extra user-friendly than Aura's. We battled to add brand-new info and switch in between tools.

Everything about Identity Protection Tools

Identification Guard's budget-focused Value plan is just one of one of the most economical alternatives anywhere, yet it and the Overall plan both do not have credit history security. This was a similar situation we found ourselves in with Zander Insurance coverage's registration strategies. Only the Ultra plan consists of credit scores tracking, a core function of ID burglary monitoring you would not wish to do without.

The application can just look for card numbers in information breaches. While credit report card scams is one of one of the most common sorts of credit score identification burglary, we're not convinced that suffices for complete security (click here). 3 If you like Surfshark however want debt surveillance, think about incorporating your Surfshark subscription with Experian's complimentary one-bureau credit surveillance

Surfshark specializes in cybersecurity. For the ultimate defense, we advise the Surfshark One registration, that includes its premier VPN and anti-viruses software program. For an additional $1.50 a month on a two-year membership, you can include Incogni, which is one of our favorite data removal solutions. Surfshark Alert alerting us of a data violation.

, and TotalAV, for instance, all fold up some kind of ID theft surveillance into their malware protection. We found Identity Guard's desktop computer control panel a lot more user-friendly than Aura's. We struggled to add brand-new details and button in between devices.

Identity Guard's budget-focused Value strategy is just one of one of the most budget-friendly choices anywhere, yet it and the Total plan both do not have credit score security (click here). This was a comparable dilemma we discovered ourselves in with Zander Insurance's membership plans. Just the Ultra plan consists of credit score tracking, a core feature of ID burglary monitoring you would not intend to do without

The application can only look for card numbers in data breaches. While bank card fraud is just one of one of the most usual kinds of credit score identity theft, we're not convinced that's sufficient for full security. 3 If you like Surfshark however desire credit surveillance, consider integrating your Surfshark registration with Experian's free one-bureau credit rating surveillance.

Identity Protection Tools - An Overview

For the ultimate protection, we advise the Surfshark One subscription, which includes its premier VPN and anti-viruses software program., which is one of our favorite information elimination services.

Latest Posts

Not known Details About Identity Protection Tools

6 Easy Facts About Identity Protection Tools Shown

The Best Strategy To Use For Identity Protection Tools